Archive for February 2011

Finance dept. in Japanese companies (vol.3)

TweetThe Company Code (Japanese law of corporations) requires to appoint a corporate auditor (article 327) if a board of directors is implemented.

In most of cases someone in head office or a regional office, like a head of internal control or a legal council is appointed as a corporate auditor.

Some companies have a policy that a finance personnel in head office or a regional office cannot be an auditor, due to the segregation duty.

A corporate auditor is to audit financial statements based on Japanese GAAP including income statement, balance sheet, business report and supplemental schedules.

Since it is not practical for an auditor to come to Japan for his/her field work, he/she just relies on an internal audit if applicable.

If not, he/she relies on an independent auditor who performs a consolidation audit.

As a licensed CPA in Japan, Yoda Accounting Office also performs such audit services. Please contact if needed.

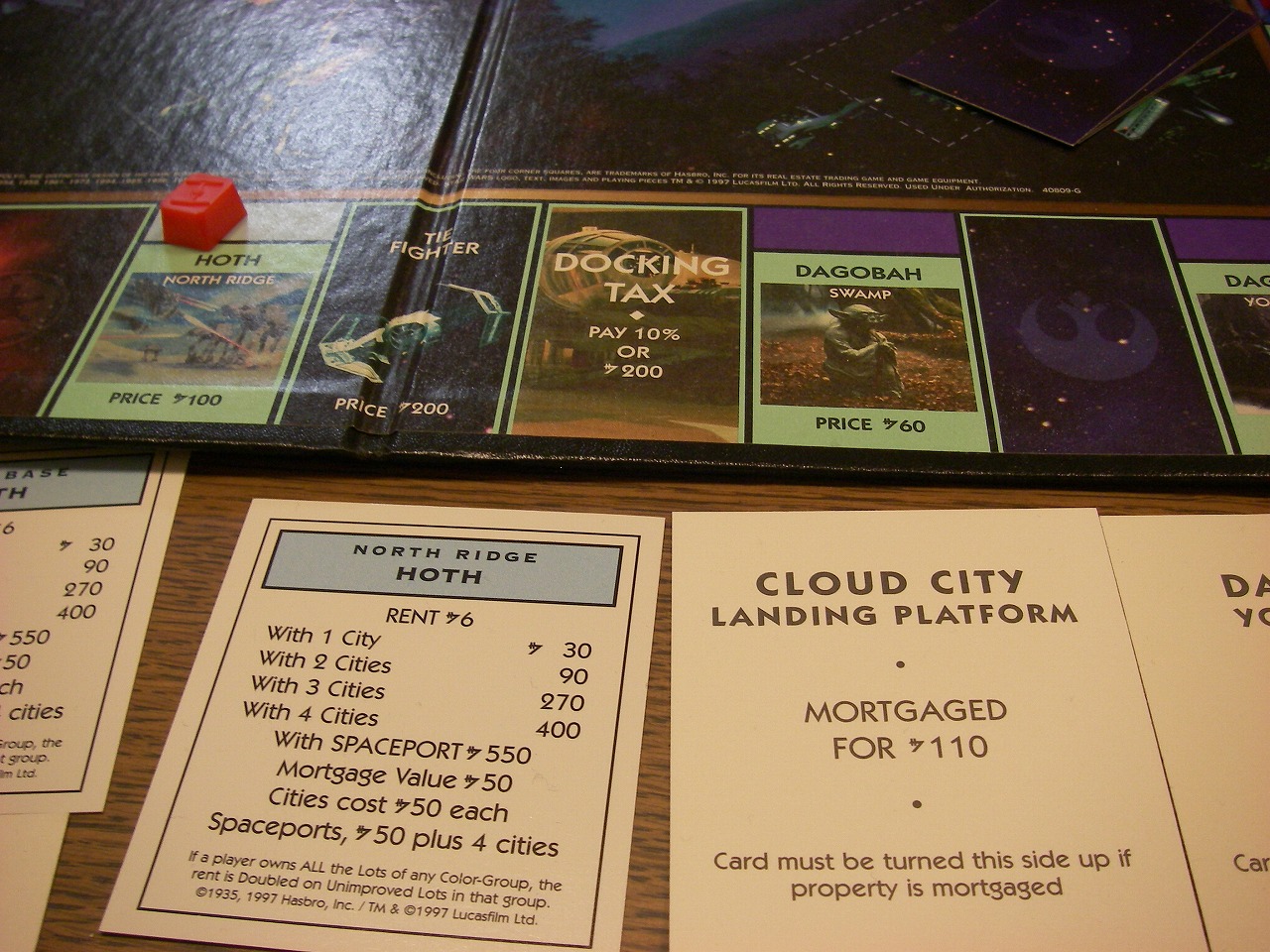

A game ‘Monopoly’ and business growth

TweetA child of my friend visited us and we played Monopoly together.

Monopoly is, as you may know, a game to buy properties on the game board, build houses and earn rents from other players when they stop at the properties.

A key of success of the game is to buy properties as much as possible, and to build houses and earn rents as soon as possible at the early stage.

I was successful to buy properties somehow at the early stage, but my dice was not good and I was force to stop a penalty tax spot while I earned money.

Therefore I could not have enough cash and could not build houses on my properties. Then I was struggling with lower rents to earn.

Monopoly is just a game but this situation suggests us various points.

At the business growing stage, even though you may have good resources (properties in this case) the growth may stay low if you do not have enough cash to develop more.

I could earn some petty cash in the middle stage and could buy houses. That helped me to pay back my investments.

If you would not raise enough funds to grow your business, it can be a key of your success for you to earn your own money with some self-developed business.

Photo:A penalty tax spot hurt me.

How important cashflow is as a general sense

TweetIn the other day I was helping to develop a business plan.

The original version the client prepared included the reimbursement to a bank as a cost. In the other hand a depreciation was not included.

As you may know the reimbursement to a bank is not a cost, while a depreciation should be included as a cost.

This concept is very much basic for accountants, but not for everyone.

However the point was that the client’s view was how much the cash balance remains on his hand.

It is also an accounting basic that a profit in accounting is different from a cash balance on hand. However “cash is king” for a management is very important to see how much the cash balance will be.

The client knows the cash flow management in a general sense.

An accountant may pay attention to an appropriate transaction in accounting, but the true engine running a company is cash generation.

We may always want to realize how much the cash will remain and what the source of cash generation is.