Controlling

Another “souteigai” or outside of immagination – who bears the cost?

TweetIt has been told that The Tokyo Electric Power Company (TEPCO) assumed that the tsunami damage was outside of imagination for its Fukushima Nuclear Power Station #1.

Today we do not discuss about it was right or not, but we may see there was another “outside of imagination” for this matter.

It was not clear who would bear the cost in case of this kind of accidents.

TEPCO is now considered to take the primary responsibility, but could have the exemption according to the Atomic Energy Damage Compensation Law. However the condition of the exemption was not clearly defined and many discussions are made how to deal with the law.

This can happen not only in nuclear power station accidents but also in daily business contracts. However most of typical Japanese contracts do not define detailed clauses but just describe “in case of matters that this contract does not define, the both parties may deal with such matters with discussions faithfully”.

Essentially this means a matter outside of imagination will be discussed when happened.

Nobody wants to bear costs over his/her responsibilities. In case of the matters “outside of imagination”, many various arguments may incur who will bear the cost, and the time goes by without any conclusions.

The absence of the conclusion may affect on the cost estimation in financial closing.

Generally a provision has to be recognized when the cost will incur probably and the amount can be estimated rationally. However it cannot be estimated if the conclusion is not made who bears the cost.

It may trouble accountants.

When you make a contract, it would be better to define many matters without easily leaving as “outside of imagination”, and you may avoid useless arguments and may be able to respond financial actions.

Accountants may have to prepare for such cases with “imagination” as day-to-day business.

A game ‘Monopoly’ and business growth

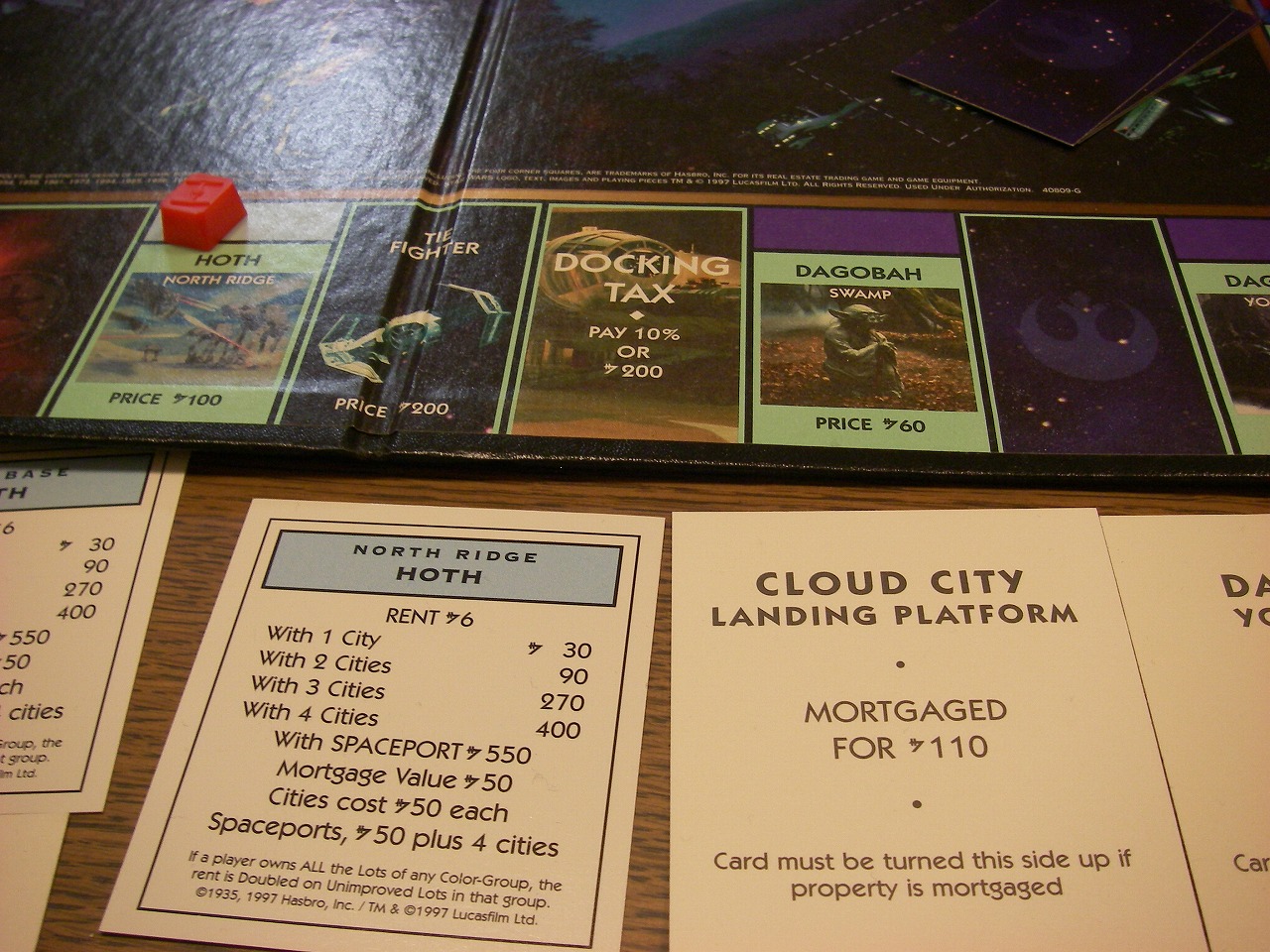

TweetA child of my friend visited us and we played Monopoly together.

Monopoly is, as you may know, a game to buy properties on the game board, build houses and earn rents from other players when they stop at the properties.

A key of success of the game is to buy properties as much as possible, and to build houses and earn rents as soon as possible at the early stage.

I was successful to buy properties somehow at the early stage, but my dice was not good and I was force to stop a penalty tax spot while I earned money.

Therefore I could not have enough cash and could not build houses on my properties. Then I was struggling with lower rents to earn.

Monopoly is just a game but this situation suggests us various points.

At the business growing stage, even though you may have good resources (properties in this case) the growth may stay low if you do not have enough cash to develop more.

I could earn some petty cash in the middle stage and could buy houses. That helped me to pay back my investments.

If you would not raise enough funds to grow your business, it can be a key of your success for you to earn your own money with some self-developed business.

Photo:A penalty tax spot hurt me.

To see the future (vol.1)

TweetI was in a subway train yesterday morning.

A train behind us was cancelled due to a mechanical trouble, then our train was also delayed to adjust the interval.

Announcements were telling the status of the delay and apologizing.

The trouble shooting has been much improved while there was no announce or it was unclear a few years ago.

One thing I found, however, was that they told us what the cause was and the status, but not the forecast of the recovery.

Passengers may understand the situation if they know the cause, but it is not enough to make a decision what they do next.

If you are in a hurry, you have to make a decision to get off the train and choose an alternate route, or to remain in the train to wait for the recovery.

In order to make the decision, you may want to know how late the train will be, and how soon it is recovered.

It is same for the financial management of companies.

It is hardly usual that a business goes as planned. It is important for running a business to know not only the past(=actual) but also the future that what the year-end will be, or when and how much the profit will be, etc.

If the information is available, you will be able to make a decision to go, or to take a certain action.

Finance sometimes means the figures in the past or closing, but more importantly, whether it is useful for future decision making.