Finance

ROE of Japanese companies recovered

TweetAccording to Nikkei, a financial news paper, reported on July 3rd that an average ROE of Japanese listed companies recovered to 6.0% as of March 31, 2011, which is 2.1% better than the last fiscal year.

However an average ROE of US and European companies reaches over 10%.

It has been spoken that ROE of Japanese companies has been low.

I see two following aspects for the reason.

One is the high corporate tax rate.

The effective corporate tax rate in Japan is around 40%. US’s one is similar, but Europeans’ are around 30%.

Therefore the ROEs before tax are:

Japan ROE=6.0%/(1-40%)=10%

European ROE=10%/(1-30%)=14%

Although Europeans are higher, but Japanese comes close.

If Japanese gains as Europeans do, ROE has to be 10%/(1-40%)=16.7%, which is much higher.

Japanese industries’ leaders complain the government how high the tax rate is, and the calculation above realizes how high.

The other aspect I assume is pricing.

Many US and European companies with strong brands earn high margins.

Louis Vuitton or Mercedes may earn a lot of margins.

In the other hand, SONY, Panasonic, or Toyota is also a global brand but they do not earn high margins.

The variance of margins may lead to the variance of ROEs.

The value strategies of Japanese companies are not wrong.

It has been told that Japanese products have reasonable prices and good qualities. The lower margins of Japanese companies are realize by such low prices.

In the value strategies of Japanese companies, the values are not gained by capitals through ROE but by customers.

Capitals seem losing the values to be earned, but gaining the sustainable growth through the customer loyalty with low margins.

Have you already had a successor in finance?

TweetThe season comes that a finance/accounting personnel transfers.

Some of you have already received your subordinate’s resignation.

Have you already had his/her successor?

In Japan it is allowed to leave with one month notice according to an employment rule.

However, it is not easy to find his/her successor just after you have received his/her resignation.

Your business will stop if you would not have his/her successor.

Yoda Accounting Office provides you a support service to fulfill the vacancy of your resigning subordinates.

The roles we provide are;

1. Interim CFO, interim controller, or interim finance manager

2. Closing month-end or year-end, reporting to the management, the regional office or the head quarter

3. Budgeting and planning, analysis of the management report and forecasting

4. Analyzing the variance between the plan and the actual, management report and audit.

5. Daily transactions, accounting entries and also cash management including daily monitoring as a treasury.

6. other finance/accounting ad-hoc tasks

We will provide you a flexible service with a full-time service or a part-time service.

Please refer thedetails of this service.

Please feel free to contact us through the contact page.

A document to understand easily (1)

TweetA season for finance/accounting to move comes in Japan.

A fiscal year of most of Japanese companies end in March. Then May or June, after the closing in March, is the good time to change jobs.

A job change means your role is taken over by someone else, or you take over someone’s role.

You are happy if you have your successor to take over you, or you have the predecessor you take over.

However you may retire before your successor joins, or your predecessor may have already left when you join.

You may have to do your job by your own based on documents your predecessor left if your predecessor has already left.

In Japan, sometimes job descriptions are not always clear, or roles and responsibilities are not always clearly defined.

Some works may be highly dependent on individuals and not documented enough.

I have seen the following situation when I joined without my predecessor remaining.

1. Paper documentations

1-1. It is unknown where the documents are stored.

1-2. Document list of carton box archive is not organized (e.g. just written “xx documents”) and you have to open all documents to see what are stored.

1-3. A formulas is unknown and it is hard to know what items are calculated to a certain figure in a spreadsheet.

1-4. It is unknown where the file is when you see a printed document.

2. PC files

2-1. Folders are not organized or structured systematically, it is unknown where a certain document in a certain period is stored (e.g. “Annual” and “annual” folder may be found)

2-2. Many similar files are found and it is hard to know which is the latest. (a file is saved later than the “final” file)

2-3. A source is not described and it is unknown how the figure is retrieved.

2-4. Assumptions are unknown for a budget or a forecast.

The conditions above may bring a successor troubles.

I have some skills to dig out documents, to analyze how the document is created, or to find a ‘missing-ring”.

However it is the best to avoid such troubles above.

I will describe how to avoid next time.

次回は、このような苦労を防ぐための方法についてご説明したいと思います。

Another “souteigai” or outside of immagination – who bears the cost?

TweetIt has been told that The Tokyo Electric Power Company (TEPCO) assumed that the tsunami damage was outside of imagination for its Fukushima Nuclear Power Station #1.

Today we do not discuss about it was right or not, but we may see there was another “outside of imagination” for this matter.

It was not clear who would bear the cost in case of this kind of accidents.

TEPCO is now considered to take the primary responsibility, but could have the exemption according to the Atomic Energy Damage Compensation Law. However the condition of the exemption was not clearly defined and many discussions are made how to deal with the law.

This can happen not only in nuclear power station accidents but also in daily business contracts. However most of typical Japanese contracts do not define detailed clauses but just describe “in case of matters that this contract does not define, the both parties may deal with such matters with discussions faithfully”.

Essentially this means a matter outside of imagination will be discussed when happened.

Nobody wants to bear costs over his/her responsibilities. In case of the matters “outside of imagination”, many various arguments may incur who will bear the cost, and the time goes by without any conclusions.

The absence of the conclusion may affect on the cost estimation in financial closing.

Generally a provision has to be recognized when the cost will incur probably and the amount can be estimated rationally. However it cannot be estimated if the conclusion is not made who bears the cost.

It may trouble accountants.

When you make a contract, it would be better to define many matters without easily leaving as “outside of imagination”, and you may avoid useless arguments and may be able to respond financial actions.

Accountants may have to prepare for such cases with “imagination” as day-to-day business.

Entrance exam and production efficiency

TweetA few days ago, Kyoto University announced that a candidate cheated the entrance exam using a mobile device.

In Japan, an entrance exam to a collage is generally performed on paper test, at a designated place at once.

The candidate hided his mobile device and submitted the question to an internet Q&A site to seek answers. Sooner, the answers were submitted and he just copied the answer to his paper.

Candidates were supposed to switch the devices off but he did not.

This incident suggests some insights of production efficiency if the exam is considered as a production process, to produce successful candidates (products) at a exam location (a plant).

The current exam system in Japan is a kind of ‘mass production’ with following aspects.

1. Input thousands candidates (raw material) into one place at a designated date.

2. To choose successful candidates through several processes at an exam location (plant)

3. To produce hundreds successful candidates (mass production)

4. Questions and evaluations are objective in a certain standard (standard process, quality standard)

The cheating incident has destroyed the assumption of mass production with new technology.

This cheating was brought to the process like as a defect beyond the assumption to detect by current observations (=check process before input).

The following solutions can be introduced.

1. Reinforce check process before input

I took a USCPA exam a year ago. It strictly prohibits to bring something to the location with some checking processes.

This may not input any defect materials into a production process.

The method may mitigate the cost of subsequent processes, but the check at the first process can be more and costly.

2. Reinforce check process after production

Statistically a defect cannot be zero no matter how many check processes are introduced. Therefore it is assumed that defects can be made in a certain rate to be accepted and to be removed at the final process.

In this incident, check processes at the location are not to be reinforced but the evaluation process may decline answers similar to such Q&A sites.

This method may mitigate the beginning processes, but the final process becomes costly.

3. Scale down the batch size and introduce high-mix low-volume production

The reason of amount of costs for 1. and 2. above is the assumption of mass production.

It is costly to check many candidates if they cheat at once.

If the batch sizes of each processes are scaled down, a cost of each batch can be reduced.

In this incident, the exams can be performed several times much earlier with fewer successful passes at an exam.

This method may increase production times in processes and may decrease efficiency. However this can be more flexible to many potential incidents.

For the assumption of mass production, resource problems can arise such as location, observers and evaluators. The solution 3. may increase exam processes but the resource can be less.

1. or 2. assumes process industry with mass production, while 3. assumes a cellular manufacturing system.

Finance dept. in Japanese companies (vol.3)

TweetThe Company Code (Japanese law of corporations) requires to appoint a corporate auditor (article 327) if a board of directors is implemented.

In most of cases someone in head office or a regional office, like a head of internal control or a legal council is appointed as a corporate auditor.

Some companies have a policy that a finance personnel in head office or a regional office cannot be an auditor, due to the segregation duty.

A corporate auditor is to audit financial statements based on Japanese GAAP including income statement, balance sheet, business report and supplemental schedules.

Since it is not practical for an auditor to come to Japan for his/her field work, he/she just relies on an internal audit if applicable.

If not, he/she relies on an independent auditor who performs a consolidation audit.

As a licensed CPA in Japan, Yoda Accounting Office also performs such audit services. Please contact if needed.

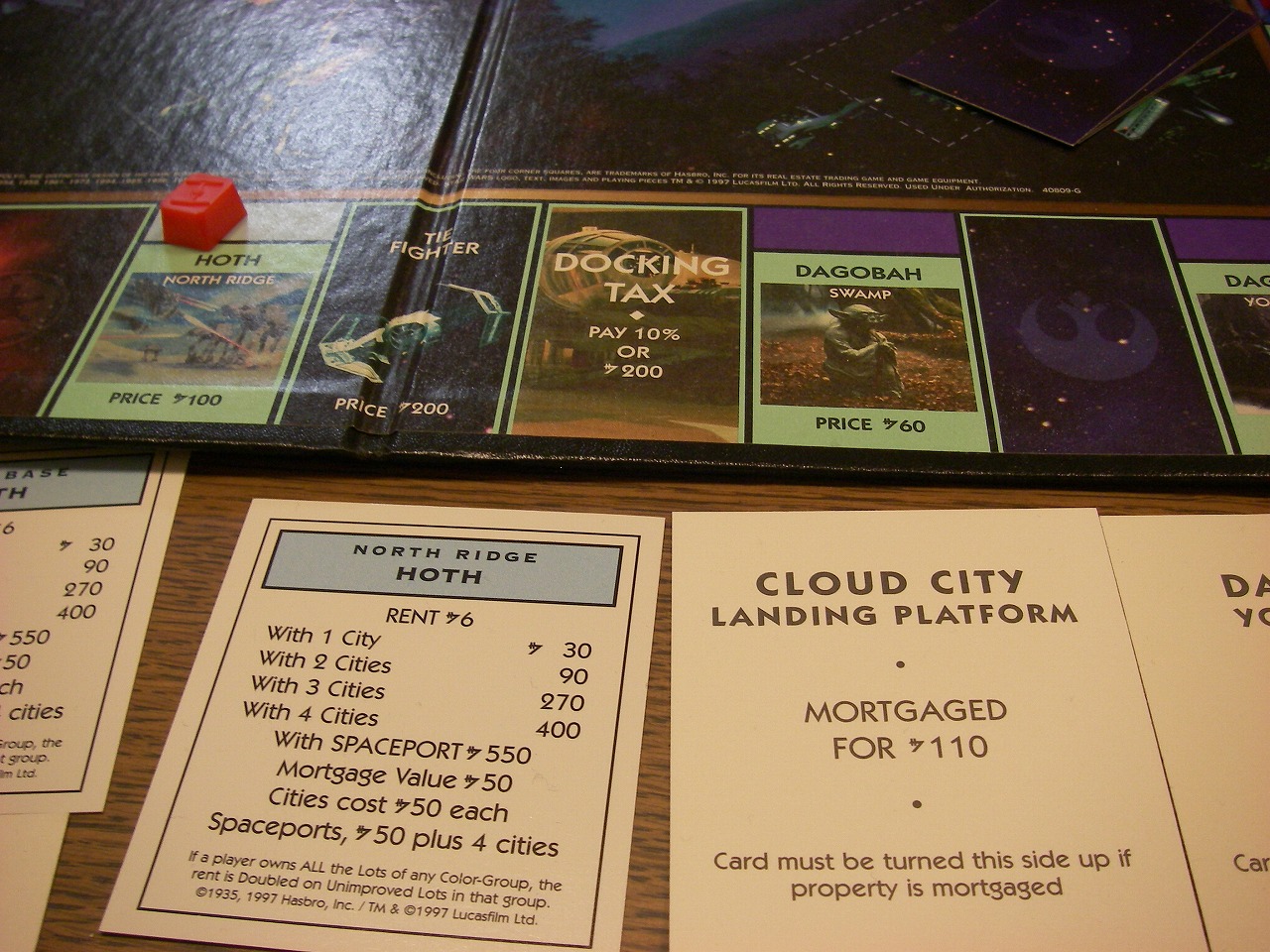

A game ‘Monopoly’ and business growth

TweetA child of my friend visited us and we played Monopoly together.

Monopoly is, as you may know, a game to buy properties on the game board, build houses and earn rents from other players when they stop at the properties.

A key of success of the game is to buy properties as much as possible, and to build houses and earn rents as soon as possible at the early stage.

I was successful to buy properties somehow at the early stage, but my dice was not good and I was force to stop a penalty tax spot while I earned money.

Therefore I could not have enough cash and could not build houses on my properties. Then I was struggling with lower rents to earn.

Monopoly is just a game but this situation suggests us various points.

At the business growing stage, even though you may have good resources (properties in this case) the growth may stay low if you do not have enough cash to develop more.

I could earn some petty cash in the middle stage and could buy houses. That helped me to pay back my investments.

If you would not raise enough funds to grow your business, it can be a key of your success for you to earn your own money with some self-developed business.

Photo:A penalty tax spot hurt me.

How important cashflow is as a general sense

TweetIn the other day I was helping to develop a business plan.

The original version the client prepared included the reimbursement to a bank as a cost. In the other hand a depreciation was not included.

As you may know the reimbursement to a bank is not a cost, while a depreciation should be included as a cost.

This concept is very much basic for accountants, but not for everyone.

However the point was that the client’s view was how much the cash balance remains on his hand.

It is also an accounting basic that a profit in accounting is different from a cash balance on hand. However “cash is king” for a management is very important to see how much the cash balance will be.

The client knows the cash flow management in a general sense.

An accountant may pay attention to an appropriate transaction in accounting, but the true engine running a company is cash generation.

We may always want to realize how much the cash will remain and what the source of cash generation is.

Finance dept. in Japanese companies (vol.2)

TweetAs discussed previously, most of domestic Japanese companies require more than two weeks to close monthly report due to the attention on accuracy rather than timeliness. The business insight is also merely discussed but just analysis of the actual figures is discussed.

These circumstances are generated from tax accounting requirement. Most of Japanese companies are very conscious about the tax requirement and the accounting books are mostly based on tax accounting policy.

Of course management reports with business insights are prepared, but by various operating divisions and not organized or integrated.

Finance dept. is expected to organize them but sometimes there are some discrepancies between the finance and other operating divisions.

Therefore an integration of management reporting is required under one-voice controlship.

Yoda Accounting Office is ready to assist you to establish your business in Japan or invest on Japanese companies. Please feel free to contact us through the form.

Finance dept. in Japanese companies (vol.1)

TweetFinance department in Japanese companies are not always same as the ‘finance’ department in other countries.

Finance functions are almost same such as book keeping, collecting money from customers, paying money to suppliers and reporting to the management.

Most of Japanese (especially domestic) companies pay attention on accuracy and tax-oriented accounting. Monthly closing sometimes require more than two weeks, that is because such accounting method does not allow accruals for tax reasons.

Another difference is FP&A function. Most of Japanese companies’ finance consist of financial accounting and treasury, but not FP&A.

Such business analysis and planning function is provided by a corporate planning section, or planning section even in sales section or other operational sections.

It is important how to establish the relationship between finance and such corporate planning sections in terms of analysis in financial point of view.

Yoda Accounting Office is ready to assist you to establish your business in Japan or invest on Japanese companies. Please feel free to contact us through the form.